CMHC MLI Select Program

Discussing how multifamily investors can leverage it for their investments.

1. Can you give us an introduction of yourself and what is your main focus in our market.

Founded in 1977, Realtech Capital Group is an experienced Vancouver-based commercial mortgage advisory and lending firm. Depending on our client’s needs, we can structure acquisition, construction, and take-out financing. We also provide private financing for investors and developers to fill the gap that conventional lenders leave. The projects we work on range from spec townhomes to master-planned community developments with some of the region’s most sophisticated groups. We strive to work with reputable groups with a view to long-term relationships.

In recent years, CMHC-insured financing solutions have become a large part of our business and we are a CMHC-approved correspondent. Being an approved correspondent allows us to run the CMHC application process for our clients to obtain CMHC’s certificate of insurance (COI) and to cover the market of CMHC-approved lenders to present the most competitive terms and options to our clients. The CMHC Market program has been very popular due to the lower interest rates and higher loan amounts compared to conventional term loans. On the purpose-built-rental construction side, developers are taking advantage of CMHC’s newer MLI Select program which offers competitive leverage and interest rates. What many people don’t know is that MLI Select is available for existing buildings as well.

2. What is the difference between the MLI Select and Market CMHC Rental programs?

The MLI Select is a relatively new CMHC loan insurance program that is focused on CMHC’s three pillars for better outcomes: affordability, accessibility, and climate compatibility. This program encourages borrowers to take steps in one or more of the three categories for better outcomes by offering better underwriting parameters compared to the Market program. The improved underwriting metrics typically increase the loan amount and offer lower premiums compared to the Market program. MLI Select also has a limited-recourse option which the Market program does not offer.

3. What standards do borrowers need to meet in order to qualify for the MLI Select program?

The beauty of the MLI Select program is that the borrower can choose which outcomes or mix of outcomes to focus on. The minimum number of points required to qualify for this program is 50 points. The next threshold is 70 points and the final one is 100 points. Once you reach 100 points, there are no additional benefits to obtaining further points. Between the 50, 70, and 100-point thresholds, the higher the points, the better the terms of the insured loan.

The great thing about this program is that it inherently recognizes that every multi-family building is unique. Some buildings can easily achieve higher energy efficiency levels, while other buildings may have a hard time improving their efficiency and therefore have to discount a portion of their rents to qualify.

Please see the point distribution table below for more information:

4. What are the benefits and terms associated with each point level?

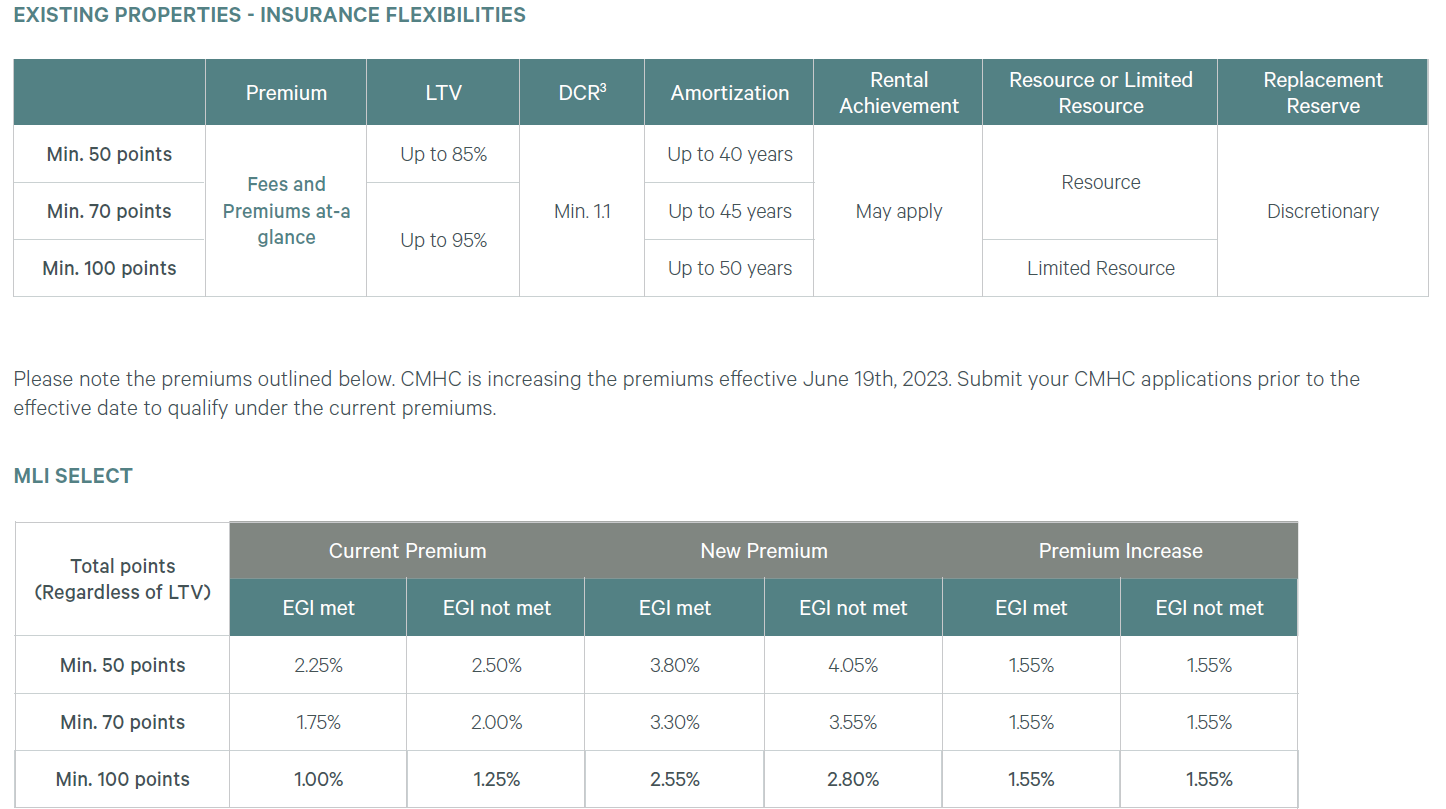

The benefits and terms differ depending on the point level. Below are the benefits and terms explained with commentary on how each impacts the loan:

a) The amortization period increases with each point threshold, ultimately giving borrowers a larger loan amount. For older buildings, it is best to get a building condition report concluding a useful economic life that matches or exceeds the appropriate amortization period.

b) The maximum loan-to-value (LTV) is 85% for borrowers that obtain 50 points. For borrowers that reach 70 points or more, the maximum LTV is 95%. LTVs are also subject to meeting the income test.

c) For borrowers that achieve 100 points, limited recourse is available.

d) MLI Select offers a lower debt coverage ratio (DCR) of 1.10X for all point levels when compared to CMHC’s Market program which uses a DCR of 1.30X for 5-year terms and 1.20X for 10-year terms. MLI Select’s lower DCR requirement increases the underwriting loan amount.

e) The CMHC premium for an MLI Select loan varies depending on the point level achieved. When compared to the Market program’s insurance premium, the MLI Select premium is on average significantly lower. The Market premium starts at a base premium of 1.75% and goes up to 4.50% depending on the LTV. The Market premium further adds 0.25% for each 5-year amortization period beyond 25 years. As a benchmark, a CMHC Market program that achieves 85% LTV with a 40-year amortization will command a premium of 5.25%.

Please see below for the full table:

5. The MLI Select program sounds great, but not many borrowers are looking at this program for new acquisitions. Can you provide commentary on why that might be? Are they all wrong?

I wouldn’t say anyone is right or wrong for going with CMHC Market, MLI Select, conventional term, or short-term interest-only. It’s really up to the borrower’s vision for what they want to do with a given property, what is feasible given the unique physical constraints of the property, and what the numbers look like.

However, I would stress the importance of getting consultants involved early in the process to see what is feasible. My clients typically engage me early in a process to model out different financing scenarios to see if affordability is achievable. If a client wants to explore energy efficiency, my advice is to get an approved engineer or architect involved as soon as possible to map out the costs of reducing energy outputs. The same applies to accessibility; a qualified architect has to be engaged early.

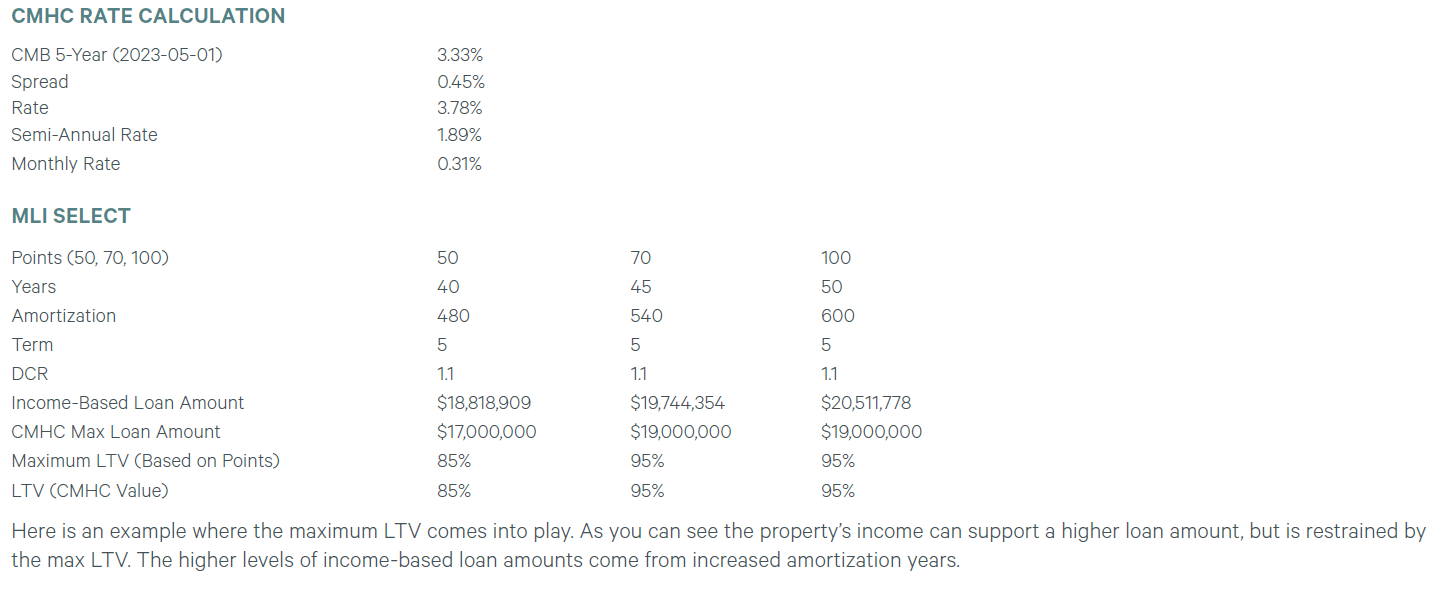

6. How are the interest rates determined for CMHC programs? What are the rates coming in today?

When we talk about rates, we have to make an important distinction between the underwriting rate and the interest rate for the loan. The underwriting rate is the rate that is used to determine the loan amount. This interest rate shows up on CMHC’s certificate of insurance (COI) and is fixed upon issuance of the COI (although you can amend this for a fee). A typical underwriting rate would be around CMB + 0.50%.

The actual interest rate for the loan is the rate that will impact your monthly payments and this rate can be different from the underwriting rate for two reasons. The first reason is that the underlying bonds are constantly moving. Most competitive CMHC-approved lenders are CMB* based, but some are cost-of-funds (COF)-based and these underlying rates move between the time you get your COI to the funding date or interest-lock date. Most lenders have interest-rate hedging mechanisms to fix the rate in advance and the hedge costs vary from lender to lender. Hedge costs are typically added to the interest rate. Secondly, the lender’s profit (spread) above the underlying bond might be tighter or wider depending on the specifics of the loan such as the size of the loan and the borrower’s experience. Generally, for larger loans, lenders can reduce the spread while smaller loans might require a larger spread – this is due to scale. Lenders will also bid more aggressively for strong borrowers with solid property management experience. Lenders are also able to reduce their spreads on MLI Select loans that have a component of affordability.

*CMB (Canada Mortgage Bond) is a CMHC-guaranteed bond used for investment opportunities into residential mortgages.

7. What are some of the most common energy efficiency upgrades an owner or new buyer can do to take advantage of this program?

Of course, I am not a qualified professional engineer or architect and I would encourage clients to engage qualified professionals early in the process, but here are a few examples that I have seen: replace existing windows with double-glazed vinyl frame windows, replace the existing water heater with air source heat pump water heaters, replace existing gas boilers with condensing boilers, and replace space heating with central air source heat pumps. Oftentimes, the upgrades chosen are measures that the owner wants to include in the building anyway.

Professionals will provide an energy analysis to present potential upgrades and their benefits to meet MLI Select program targets. Please contact a qualified professional for more details.

8. Does an owner or buyer need to complete these upgrades prior to securing the loan or can it be done at a later date?

That depends on the timeline and source of capital for the improvements. I have broken it down into three scenarios:

1. When Improvements or construction are undertaken prior to the request for loan insurance:

A) Documentation confirming achievement of the criteria is required as part of the loan insurance application.

B) Work must have been completed within 12 months of the request.

2. Where insured financing is used to undertake improvements or construction:

A) Documentation confirming achievement of the criteria is required within 60 days after the last advance.

3. Where improvements are completed with the borrower’s own resources or non-insured financing:

A) Documentation confirming achievement of the criteria is required within 24 months of the last advance.

9. Can you give us an example of a typical structure of an MLI Select loan at each different point level? i.e LTV, rates etc.

For example, a multi-family building that generates a stabilized NOI of $1,000,000 valued at a 5.00% cap rate with a CMHC value of $20,000,000: